Information to change the world | |

Find Topics, Titles, Names related to your query |

Information to change the world | |

Find Topics, Titles, Names related to your query |

|

|

Disinvestment from South Africa

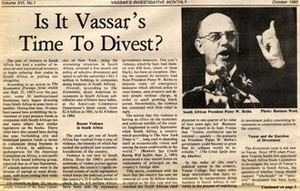

The campaign gained prominence in the mid-1980s on university campuses in the US. The debate headlined the October 1985 issue (above) of Vassar College's student newspaper.[1]

Disinvestment (or divestment) from South Africa was first advocated in the 1960s, in protest of South Africa's system of Apartheid, but was not implemented on a significant scale until the mid 1980s. The disinvestment campaign, after being realized in federal legislation enacted in 1986 by the United States, is credited[2] as pressuring the South African Government to embark on negotiations ultimately leading to the dismantling of the apartheid system.

[edit] United Nations campaign (1962-1965)

In November 1962, the United Nations General Assembly passed Resolution 1761, a non-binding resolution establishing the United Nations Special Committee against Apartheid and called for imposing economic and other sanctions on South Africa. All Western nations were unhappy with the call for sanctions and as a result boycotted the committee.[3] Following this passage of this resolution the UK-based Anti-Apartheid Movement spearheaded the arrangements for an international conference on sanctions to be held in London in April 1964. According to Lisson, "The aim of the Conference was to work out the practicability of economic sanctions and their implications on the economies of South Africa, the UK, the US and the Protectorates. Knowing that the strongest opposition to the application of sanctions came from the West (and within the West, Britain), the Committee made every effort to attract as wide and varied a number of speakers and participants as possible so that the Conference findings would be regarded as objective."[3] The conference was named the International Conference for Economic Sanctions Against South Africa. This conference, Lisson writes,

[edit] Attempts to persuade British policymakersThe conference was not successful in persuading Britain to take up economic sanctions against South African though. Rather, the British government "remained firm in its view that the imposition of sanctions would be unconstitutional "because we do not accept that this situation in South Africa constitutes a threat to international peace and security and we do not in any case believe that sanctions would have the effect of persuading the South African Government to change its policies'."[3] The AAM tried to make sanctions an election issue in the 1964 General Election in Britain. Candidates were asked to state their position on economic sanctions and other punitive measures against the South African government. Most candidates who responded answered in the affirmative. After the Labour Party sweep to power though, commitment to the anti-apartheid cause dissipated. In short order, Labour Party leader Harold Wilson told the press that his Labour Party was "not in favour of trade sanctions partly because, even if fully effective, they would harm the people we are most concerned about - the Africans and those white South Africans who are having to maintain some standard of decency there."[3] Even so, Lisson writes that the "AAM still hoped that the new Labour Government would be more sensitive to the demands of public opinion than the previous Government." But by the end of 1964, it was clear that the election of the Labour Party had made little difference in the governments overall unwillingness to imposing sanctions. [edit] Steadfast rejection by the WestLisson summarizes the dismal situation at the UN in 1964:

According to Lisson, Britain's rejection was premised on its economics interests in South Africa, which would be put at risk if any type of meaningful economic sanctions were put in place. [edit] United States campaign (1977-1989)[edit] The Sullivan Principles (1977)Main article: Sullivan Principles

Knight[4] writes that anti-Apartheid movement in the U.S found that Washington was unwilling to get involved in economically isolating South Africa. The movement responded by organized lobbying of individual businesses and institutional investors to end their involvement with or investments in the apartheid state as a matter of corporate social responsibility. This campaign was coordinated by several faith-based institutional investors eventually leading to the creation of the Interfaith Center on Corporate Responsibility. An array of celebrities, including singer Paul Simon, also participated. The key instrument of this campaign was the so-called Sullivan Principles, authored by and named after the Rev. Leon Sullivan. Leon Sullivan was an African-American preacher who, in 1977, was also a board member of the corporate giant General Motors. At that time, General Motors was the largest employer of blacks in South Africa. The principles required that the corporation ensure that all employees are treated equally and in an integrated environment, both in and outside the workplace, and regardless of race, as a condition of doing business. These principles directly conflicted with the mandated racial discrimination and segregation policies of apartheid-era South Africa, thus making it impossible for businesses adopting the Sullivan Principles to continue doing business there. While the anti-Apartheid movement lobbied individual businesses to adopt and comply with the Sullivan Principles, the movement opened an additional front with the institutional investors. Besides advocating that institutional investors withdraw any direct investments in South African-based companies, anti-Apartheid activists also lobbied for the divestment from all U.S.-based companies having South African interests who had not yet themselves adopted the Sullivan Principles. The institutional investors such as public pension funds were the most susceptible to these types of lobbying efforts. Public companies with South Africa interests were thus confronted on two levels: First, shareholder resolutions were submitted by concerned stockholders who, admitted, posed more of a threat to the often-cherished corporate reputations than to the stock price. Second, the companies were presented with the significant financial threat where by one or more of their major institutional investors decides to withdraw their investments. [edit] Achieving critical mass (1984-1989)The disinvestment campaign in the United States, which had been in existence for quite some years, gained critical mass following the Black political resistance to the 1983 South African constitution which included a "complex set of segregated parliaments." Richard Knight writes:

The result of the widely televised South African response was "a dramatic expansion of international actions to isolate apartheid, actions that combined with the internal situation to force dramatic changes in South Africa's international economic relations."[4] [edit] University campusesThe anti-Apartheid disinvestment campaign on campuses began on the West coast in 1977 at Stanford University[5][6]. It had some early successes in 1978 at Michigan State University, which voted total divestiture [1] [7], at Columbia University.[8]; and the University of Wisconsin–Madison. Following the Michigan State University divestiture in 1978, in 1982, the State of Michigan legislature and governor voted for divestiture by all of the more than 30 State of Michigan colleges and universities, an action later struck down by the Michigan Supreme Court [2]. The initial Columbia divestment, focused largely on bonds and financial institutions directly involved with the South African regime.[9] It followed a year long campaign first initiated by students who had worked together to block the appointment of former Secretary of State Henry Kissinger to an endowed chair at the University in 1977.[10] Broadly backed by a diverse array of student groups and many notable faculty members the Committee Against Investment in South Africa held numerous teach-ins and demonstrations through the year focused on the trustees ties to the corporations doing business with South Africa. Trustee meetings were picketed and interrupted by demonstrations culminating in May 1978 in the takeover of the Graduate School of Business.[11][12] These initial successes set a pattern which was later repeated and many more campuses across the country. Activism surged in 1984 on the wave of public interest created by the wide television coverage of the then recent resistance efforts of the black South Africans. Students organized to demand that their universities "divest", meaning that the universities were to cease investing in companies that traded or had operations in South Africa. At many universities, many students and faculty protested in order to force action on the issue. For example, in April, 1986, 61 students were arrested after building a shantytown in front of the chancellor's office at UC Berkeley.[13] As a result of these organized "divestment campaigns", the boards of trustees of several prominent universities voted to divest completely from South Africa and companies with major South African interests. The first of these was Hampshire College in 1977. Harvard University only undertook a partial "divestment" from South Africa and only after significant resistance.[14] Adam Soften and Aln Wirzbicki give this description:

University of California, in contrast to the limited action undertaken by Harvard, authorized the withdrawal of three billion dollars worth of investments from the apartheid state. Nelson Mandela has stated his belief that the University of California's massive divestment was particularly significant in abolishing white-minority rule in South Africa.[15] Overall, according to Knight's analysis[4], the numbers year over year for educational institutions fully or partially divesting from South Africa were:

[edit] States and citiesIn addition to campuses, anti-apartheid activists found concerned and sympathetic legislators in cities and states. Several states and localities did pass legislation ordering the sale of such securities, most notably the city of San Francisco. The result was that "by the end of 1989 26 states, 22 counties and over 90 cities had taken some form of binding economic action against companies doing business in South Africa."[4] Many public pension funds connected to these local governments were legislated to disinvestment from South African companies. These local governments also exerted pressure via enacting selective purchasing policies, "whereby cities give preference in bidding on contracts for goods and services to those companies who do not do business in South Africa."[4] [edit] Federal involvementThe activity at the state and city level set the stage for action at the federal level. [edit] Comprehensive Anti-Apartheid ActMain article: Comprehensive Anti-Apartheid Act

This began when the Senate and Congress presented Ronald Reagan with the Comprehensive Anti-Apartheid Act of 1986. Ronald Reagan responded by using his veto, but surprisingly and in testament to the strength of the anti-Apartheid movement, the Republican controlled senate overrode his veto. Knight gives this description the act:

The results of the act were mixed in economic terms according to Knight[4]: Between 1985 and 1987, U.S. imports from South Africa declined 35%, although the trend reverses in 1988 when imports increased by 15%. Between 1985 and 1998, U.S. exports to South Africa increased by 40%. Knight attributes some of the increase in imports in 1988 to lax enforcement of the 1986 Act citing a 1989 study by the General Accounting Office. Knight writes that a "major weakness of the Act is that it does little to prohibit exports to South Africa, even in such areas as computers and other capital goods."[4] [edit] Budget Reconciliation ActA second federal measure introduced by Representative Charles Rangel in 1987 as an amendment to the Budget Reconciliation Act halted the ability of U.S. corporations from attaining tax reimbursements for taxes paid in South Africa. The result was that U.S. corporations operating in South Africa were subject to double taxation. According to Knight:

[edit] Further legislative effortsAn additionally and much harsher sanctions bill was passed by the House of Representatives (Congress) in August 1988. This bill mandated "the withdrawal of all U.S. companies from South Africa, the sale by U.S. residents of all investments in South African companies and an end to most trade, except for the import of certain strategic minerals."[4] In the end, the bill didn't become law as wasn't able to pass the Senate. (In the United States legislative system a bill must be passed by both the Senate and the House of Representatives before it can be signed into law by the President.) Even so, the fact that such a harsh bill made any progress at all though the legislature "alerted both the South African government and U.S. business that significant further sanctions were likely to be forthcoming" if the political situation in South Africa remained unchanged. [edit] Effects on South Africa[edit] Economic effectsMain article: Economic history of South Africa#Sanctions

Because of South Africa's heavy reliance on investments and trade from the West, it was particularly vulnerable to the campaign. The result was a flight of capital which plunged the economy into a prolonged period of high inflation (12% to 14% a year.)[4]

While post-colonial African countries had already imposed sanctions on South Africa in solidarity with the Defiance Campaign, these measures had little effect because of the relatively small economies of those involved. The disinvestment campaign only impacted South Africa after the major Western nations, including the United States, got involved beginning in mid-1984. From 1984 onwards, according to Knight[4], because of the disinvestment campaign and the repayment of foreign loans, South Africa experienced considerable capital flight. The net capital movement out of South Africa was:

The capital flight triggered a dramatic decline in the international exchange rate of the South African currency, the rand. The currency decline made imports more expensive which in turn caused inflation in South Africa to rise at a very steep 12-15% per year.[4] The South African government did attempt to restrict the damaging outflow of capital. Knight writes that "in September 1985 it imposed a system of exchange control and a debt repayments standstill. Under exchange control, South African residents are generally prohibited from removing capital from the country and foreign investors can only remove investments via the financial rand, which is traded at a 20% to 40% discount compared to the commercial rand. This means companies that disinvest get significantly fewer dollars for the capital they withdraw."[4] [edit] CriticismMany criticised disinvestment because of its economic impact on ordinary black South Africans. John Major said disinvestment would "feed white consciences outside South Africa, not black bellies within it". Many conservatives opposed the disinvestment campaign, accusing its advocates of hypocrisy for not also proposing that the same sanctions be leveled on either the Soviet Union or the People's Republic of China. Libertarian movement leader and polemicist Murray Rothbard also opposed this policy, asserting that the most-direct adverse impact of the boycott would actually be felt by the black workers in that country, and the best way to remedy the problem of apartheid was by promoting trade and the growth of free market capitalism in South Africa.[16] Ronald Reagan, who was the President of the United States during the time the disinvestment movement was at its peak, also opposed it, instead favoring a policy of "constructive engagement" with the Pretoria government. [edit] Further reading

[edit] See also

[edit] References

[edit] External links

Related topics in the Connexions Subject Index

Alternatives –

Left History –

Libraries & Archives –

Social Change –

This article is based on one or more articles in Wikipedia, with modifications and additional content contributed by

Connexions editors. This article, and any information from Wikipedia, is covered by a

Creative Commons Attribution-Sharealike 3.0 Unported License (CC-BY-SA) and the

GNU Free Documentation

License (GFDL). |

Connect with Connexions

|